When is the best time to transfer a defined benefit pension?

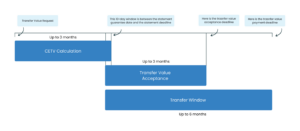

We’ve created a timeline to show how long transferring a defined benefit pension (or final salary transfer) takes to complete. It will help you decide the best time to take defined benefit pension advice. If your financial affairs are complex, gathering information and producing recommendations might take longer. Image 1: This image shows the potential CETV transfer timeline with marked deadlines

Image 1: This image shows the potential CETV transfer timeline with marked deadlines

How long does a defined benefit pension transfer take?

Depending on your circumstances, legislation & safeguarding checks by your scheme trustees, it can now take up to 9 months for a Defined Benefit Pension transfer to complete. In this article, we address the entire Defined Benefit transfer process from initial conversations, through to the transfer.When is the best time to transfer a Defined Benefit Pension?

It depends entirely on your circumstances when the best time to transfer is. The below article includes information that will help you understand when the best time for you is. If you would like to discuss your situation and find out if you’re ready for a defined benefit pension transfer, call us today for a no-obligation chat 0151 220 2619First week: Initial call from an adviser and triage

One of our financial advisers, a qualified Pension Transfer Specialist, will contact you. They will discuss your situation, explain the transfer process, and send you further information. You will decide whether to arrange a meeting with the adviser in person, by phone, or via video call. This meeting is free of charge. You will also receive triage information explaining the differences between personal and defined benefit schemes. It also covers the risks of a transfer, which may include giving up your guaranteed income for life. You get clear documentation which outlines the cost for defined benefit transfer advice. Our advisers will always be transparent with you regarding the fees involved. All our advisers operate by the CII’s Pension Transfer Gold Standard regime. You can read more about that here.Fact-finding and abridged advice: Month 1

You will have a meeting a short time after your initial call. You will be able to ask more questions and learn about the advice service and process during this meeting. Your adviser will explain the risks and benefits of transferring or not transferring your pension. They will gather information about your retirement goals and other pension funds and then analyse it to determine what is best for you. You will usually be required to provide your spouse’s or partner’s financial details. Using the analysis of your circumstances, we will produce an abridged advice report outlining whether a transfer is in your interest. We use this report to identify clear cases where a transfer will not be suitable. Important: The abridged advice report cannot analyse your transfer value and is used as a precursor to full pension transfer advice.Cash Equivalent Transfer Value (CETV) request: Month 2 & 3

If the abridged advice report concludes that you should not rule out a transfer, you can proceed to full pension transfer advice. It is up to you to decide to proceed. If you proceed, you need to request a CETV from your defined benefit pension plan’s trustees, who may have up to a month to do so. You can request a CETV yourself, but we recommend waiting for your adviser’s instruction first. There are a few reasons for this:- The three-month guarantee means you may be entitled to a refund if you do not receive your recommendation within that time.

- Your trustees may limit you to one CETV per year and can charge you for future requests.

- The CETV amount may change over time, affecting your adviser’s recommendations.

- There are multiple scheme rates and factors that the adviser will need to complete the advice, and this is not normally provided directly to members.