With increasing economic uncertainty, many investors will be seeking a steady, predictable investment option that is simple to understand. Cash interest is at an historic low point and equity markets are volatile.

Property is often regarded as a middle ground, with more growth potential than cash but more stability than shares. When thinking about your retirement, this can sound very appealing.

So is property a viable way of funding your retirement?

How You Can Use Property to Fund Your Retirement

There are a few ways in which property can fund your retirement. Not all of them require selling your home. For example:

- Downsizing to a smaller property and using some of the sales proceeds to fund your retirement.

- Taking out a lifetime mortgage to release some of the equity from your property.

- Sell some, or all, of your home to a home reversion company. You can continue to live in the property, rent-free, but the company will take possession of the property (or their allocated share) when you die.

- Using buy-to-let properties to generate an additional income stream.

Each option has its own risks and benefits. Advice should be taken before making any major decisions.

Why Invest in Property?

There are several reasons why property is an appealing investment, for example:

- There will always be a demand, as people need to live somewhere

- The investment is backed by a tangible asset that has real-world value

- Potential for capital growth as well as income

- The possibility of increasing the value of the property by choosing wisely and making improvements

- The workings of the property market are often easier to understand than the stockmarket.

But familiarity does not necessarily mean that property is the best investment choice.

Property vs the Stockmarket

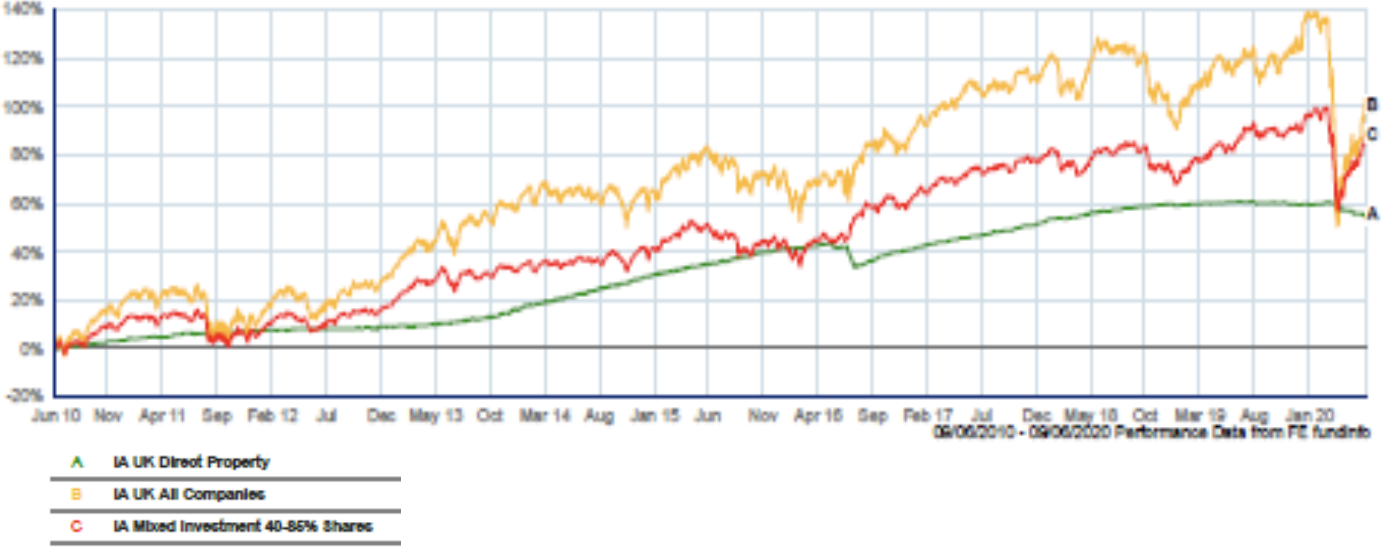

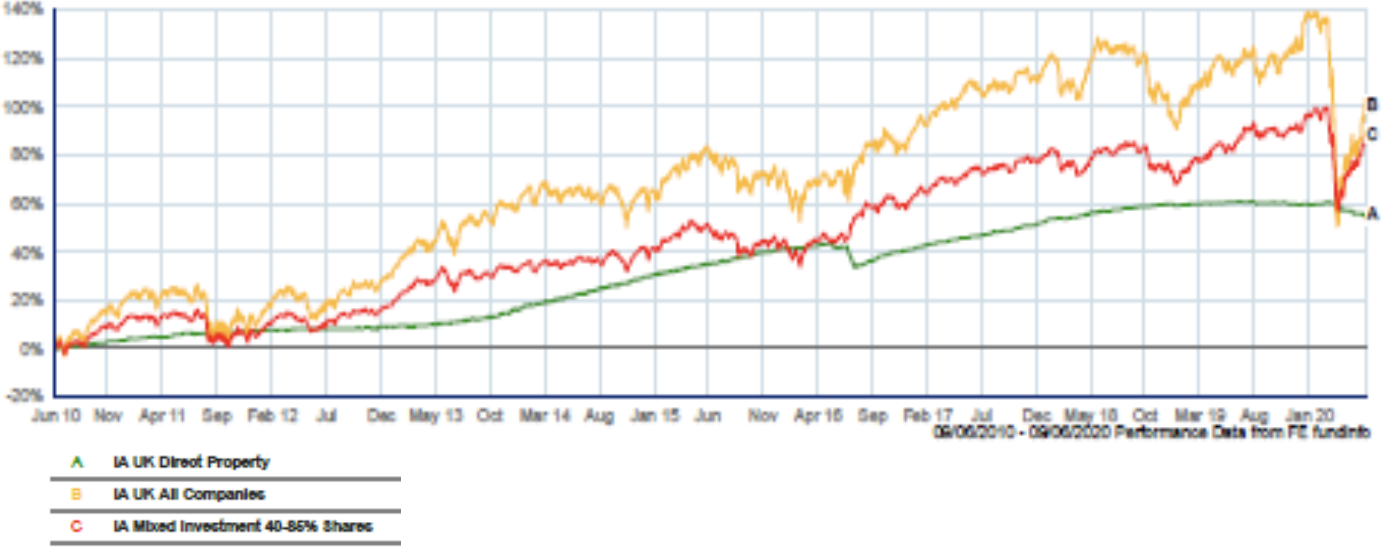

Below is a comparison of different investment types, with all income re-invested, over the past ten years:

The UK All Companies sector has produced the highest level of return (100.8%), although has also been the most volatile. Direct Property has produced steadier growth, but the long-term return (55.2%) is just over half that of UK All Companies. The Mixed Investments 40% – 85% Shares index represents a diverse, balanced portfolio. The volatility, as well as the returns (85.5%) are somewhere in between the two.

Clearly, property has lagged behind the stockmarket. While the performance over the last ten years has been steady, property funds were severely impacted by the 2008 credit crunch and resulting financial crisis. The chart above only shows the recovery that has occurred afterwards. Performance could fall further behind in the event of another dip in the property market.

A good investment strategy does not simply choose between property and shares. It uses both, as well as a wide range of other investment types, to create a diverse portfolio. Historically, property has been used as a diversifier against shares, as the values tended to move in opposite directions. This has not always been the case, but by holding a spread of investments, a portfolio gains the benefits of all asset classes, while being protected against some of the risks.

Liquidity

A major risk of property investing is that it is not liquid and it is not easy to diversify. By concentrating your wealth on one main investment, you could face problems if you need to access money quickly, particularly in a downturn. This can be worsened if you have a mortgage on the property.

Property investors also miss out on compound growth as it is not easy to reinvest rental income in more property. This is one of the most powerful aspects of stockmarket investing, as it allows your funds to grow exponentially by reinvesting interest and dividends.

Taxation

If you are relying on downsizing your home or releasing equity, tax is not a major consideration, although there are no particular tax incentives.

If you intend to rely on rental properties to fund your retirement, proceed carefully, as a number of changes have been made in recent years to make property investment less attractive. For example:

- Capital gains tax rates are 18% for basic rate taxpayers and 28% for higher rate taxpayers. Other investment types are taxed at 10% and 20% respectively. As other assets are usually more liquid, sales can be planned to make efficient use of exemptions.

- Stamp duty surcharges have been introduced, at a rate of 4% in Scotland and 3% in the rest of the UK. This is payable in addition to the standard rate of stamp duty on new purchases.

- It is no longer possible to claim higher rate tax relief on mortgage interest.

- Pensions, on the other hand, offer considerable tax advantages, including relief on contributions, tax-free growth within the funds, and a tax-free lump sum available on retirement.

If tax efficiency is a priority, pensions have a major advantage over property investments.

Practical Considerations

When planning for retirement, it’s likely that a diverse portfolio of investments within a pension wrapper will provide the best financial outcome. This isn’t guaranteed and it won’t be the best option in every situation, but generally speaking it’s a good place to start.

If you are still keen to use property to fund your retirement, there are a number of factors you should carefully consider:

- Are you prepared to move to a smaller home when you retire?

- Is it important to you that your children inherit the family home?

- Do you have other investments that you could use if required?

Are you prepared for the commitment of being a landlord, and will you feel the same in your later years?

Please don’t hesitate to contact a member of the team if you would like to find out more about your retirement options.

The UK All Companies sector has produced the highest level of return (100.8%), although has also been the most volatile. Direct Property has produced steadier growth, but the long-term return (55.2%) is just over half that of UK All Companies. The Mixed Investments 40% – 85% Shares index represents a diverse, balanced portfolio. The volatility, as well as the returns (85.5%) are somewhere in between the two.

Clearly, property has lagged behind the stockmarket. While the performance over the last ten years has been steady, property funds were severely impacted by the 2008 credit crunch and resulting financial crisis. The chart above only shows the recovery that has occurred afterwards. Performance could fall further behind in the event of another dip in the property market.

A good investment strategy does not simply choose between property and shares. It uses both, as well as a wide range of other investment types, to create a diverse portfolio. Historically, property has been used as a diversifier against shares, as the values tended to move in opposite directions. This has not always been the case, but by holding a spread of investments, a portfolio gains the benefits of all asset classes, while being protected against some of the risks.

The UK All Companies sector has produced the highest level of return (100.8%), although has also been the most volatile. Direct Property has produced steadier growth, but the long-term return (55.2%) is just over half that of UK All Companies. The Mixed Investments 40% – 85% Shares index represents a diverse, balanced portfolio. The volatility, as well as the returns (85.5%) are somewhere in between the two.

Clearly, property has lagged behind the stockmarket. While the performance over the last ten years has been steady, property funds were severely impacted by the 2008 credit crunch and resulting financial crisis. The chart above only shows the recovery that has occurred afterwards. Performance could fall further behind in the event of another dip in the property market.

A good investment strategy does not simply choose between property and shares. It uses both, as well as a wide range of other investment types, to create a diverse portfolio. Historically, property has been used as a diversifier against shares, as the values tended to move in opposite directions. This has not always been the case, but by holding a spread of investments, a portfolio gains the benefits of all asset classes, while being protected against some of the risks.

bahis siteleri

perfect

thank you for a very good article